This is not a recommendation but just our opinion. Please consult with your financial advisor before investing!

Should we fear a rise in interest rates?

Although the media continue to closely monitor developments of the covid-19 pandemic, financial markets have found another source of concern: interest rates. Indeed, investors have long been accustomed to low interest rates by central banks. In 2021, the bond markets experienced strong shocks that financiers were no longer used to. Since January 1, ten-year rates have climbed 0.63% in the United States, 0.80% in Canada and 0.53% in the United Kingdom. Even in Switzerland, Confederation rates jumped 0.30%.

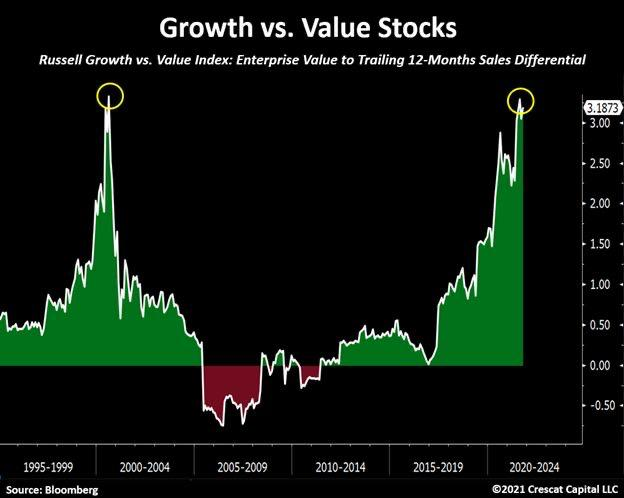

The consequences have been quite different depending on the nature of the asset. While bond indices have lost between 3% and 4.5% year-to-date, the MSCI World Equity Index is up around 1.5%. However, we need to go into more detail to see more clearly. Indeed, the rise in rates has severely penalized growth stocks, and especially high-tech stocks, due to the high and even unreasonable valuations that can be found there. We have seen stocks lose more than a third of their value in less than six weeks. Cloud, electric cars, hydrogen, and other trendy themes have seen stock prices drop significantly, between 20% and 40%! During this time, financials, securities that no one wants anymore, have soared. UBS shares have gained 16% since the start of the year, BNP Paribas 22% and Société Générale 28%. The petroleum sector, another sector out of fashion with the rise of sustainable investing, has benefited from the rise in crude prices. It must be said that the securities were too low and the dividends of 7% or 8% were too high. Total shares have gained 15% year-to-date, Royal Dutch 25%. And what about Exxon shares which rose more than 47%, not counting the dividend of 5.7% or Occidental Petroleum shares which rose almost 70%?

The real economy does not justify fears of a return to inflation, and we should not fear a significant rise in rates from current levels. We are simply witnessing a normalization of rates. However, the sector rotation which will have been accentuated by the rate hike illustrates two things. First, investors behave like sheep and are invested in the same way and miss important inflection points in the markets. Second, asset valuation is the core of any investment. Some assets now look cheap, even if rates went up a little while other assets look overly expensive, no matter what might happen to the rates.

Do not hesitate to contact us !

Contact us